I know that Real Estate investing is one of those things where it seems like you have to be rich before you can get started…but I am here to tell you that is simply not the case! The reason I love real estate investing is because there are SO many ways to start you just have to figure out which one works best for you.

Today I am going to tell you about one method where you can start with as little as $1,000! (Yes, for real!)

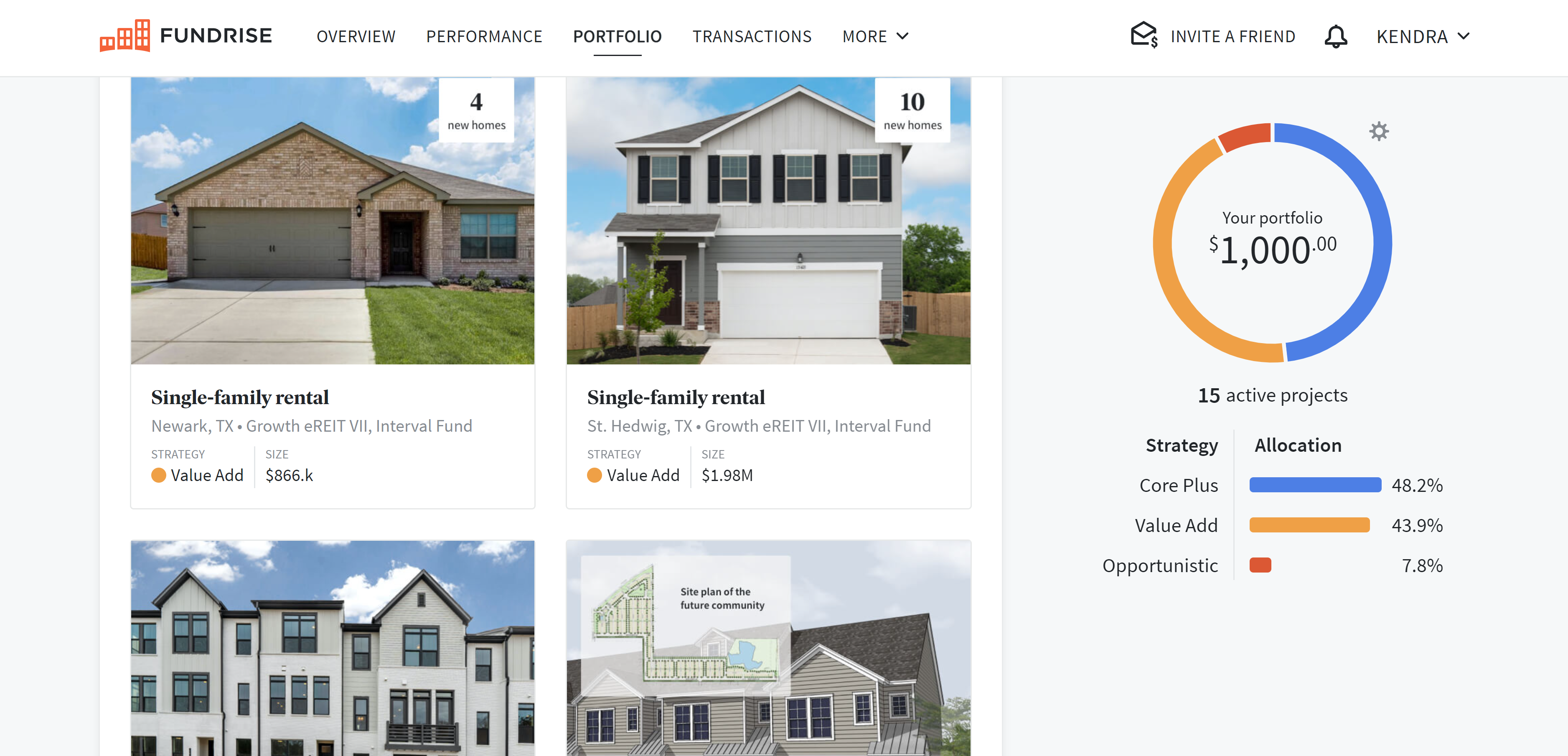

It’s called Fundrise. I recently signed up for a Fundrise account so I thought I’d share why I’m investing this way and what the benefits are.

What is Fundrise?

It’s basically a real estate crowdfunding site where real estate developers and large scale real estate investors connect with people like you and me to fund their projects.

How does it work?

Fundrise does all of the work. All you have to do is create your account, add the funds (the minimum is $1,000) and instantly your funds are invested into a variety of real estate developments where you can earn about 7% or more annually. It’s super easy! It took me about 7 minutes to set up my account. (See the video below showing you around the platform).

One thing to note is that Fundrise should be looked as a long term investment. This isn’t an account you want to take your money out of in a few months. They suggest you hold the funds in the account for at least 5 years. You can request funds before the 5 year mark, but there may be a penalty to withdraw them sooner.

If you’re thinking “Wait…hold on… I don’t want to leave my money in there that long!”. I get it! But let’s talk numbers…

Let’s go with the example of having $1,000 just sitting in a savings account. The interest on one of my savings accounts is .03% .

That means that if I have $1,000 in my savings account for one year- my bank is going to give me $.30 in interest. 30 cents!!!! Now…don’t get me wrong… having money in a savings account is important because you need funds that you can get to quickly in case something comes up, but after you’ve saved at least 3-6 months of living expenses…it’s time to start thinking about ways to make your money work harder for you!

On average, Fundrise investors make about 7%-12% in annual returns. That’s a BIG difference compared to that .03% from my savings account. If you were going to have the $1,000 just sitting in a savings account anyway…why not have it earning more over time?

Fundrise makes it easy AND affordable to invest your money, but what I love most is that it’s an extremely passive way to earn. You just set it and forget it!

Here’s a quick video showing you around the site:

This is a great option for you if you aren’t quite ready to buy your own rental properties just yet, but still want to earn some passive income or if you already own properties, but want to diversify your income streams. I know that this type of investing won’t yield the same returns as actually owning the property, but I’m still a fan of it because it’s super passive and allows me to diversify!

If you’re interested in trying Fund=,rise, here’s the link to create an account. Happy Investing!

Questions? Drop them in the comments section!

This post is a paid collaboration with Fundrise. All thoughts and opinions are my own.

I’m absolutely interested in this. I’m new to investing and I’m trying to decide between Fundrise and Diversifund. Any suggestions on what to look for in deciding which crowdfund is the better of the two?

Hey Niki! I think you should go with whichever one is the most userfriendly and has the best returns! I’m not familiar with Diversifund.

ok am i reading this correctly? If i open my account with $1000 after a year will only receive .30 cents into my account?

Nope, you should have more than 30 cents at the end of the year with Fundrise. The 30 cents example is how much interest you might have in a savings account after a year if you started out with $1,000.

[…] To be honest, even if you had $400k cash in the bank, I’d still say consider getting a mortgage because LEVERAGE is the tool of the wealthy. If you had $400k in the bank, why spend it all on ONE asset when you could spend it on several? You could spend a portion on the down payment of a home, some on a rental property, and rest on other investments like a business or stocks. Leverage and diversification of assets and income are key! [See this post: How to Invest with $1,000] […]

[…] About a month ago (on June 2nd to be exact) I opened a Fundrise account. Fundrise makes it easy to invest in Real Estate and all you need is $1,000. [More details on what Fundrise is and how here in this post] […]

[…] back in June 2021, I promised that I’d keep you posted on how it’s going. Remember- I opened it with just $1,000 (here’s the original post). Here’s a quick snapshot below showing the value now, just 5 months […]